Debt doesn't discriminate.

Piere has partnered with The National Foundation for Credit Counseling to help you regain control of your finances and connect with a nonprofit, certified credit counselor today.

A partner to trust.

As a trusted partner to Piere, the National Foundation for Credit Counseling knows that debt can quickly become overwhelming. We’re here to help.

Together, we’re working to provide valuable education, insights, and access to resources that can help you better understand and regain control of your finances.

Through our partnership, you’re able to connect free-of-charge with a nonprofit, certified credit counselor, who can review your situation and provide valuable guidance and resources, including a personalized action plan to help you tackle your debt.

Jennifer

I am only in the beginning stages but, so far, everything in my “plan” to financial stability seems to be going smoothly. I feel more prepared to handle my financial situation.

Deborah

My daughter referred me! This program will help me pay off the debt faster and free up some money to start putting toward my retirement fund.

Leanne

We realized that we had more expenses than income. My counselor helped me prioritize my expenses and informed me of options to handle my debt. She provided suggestions on how to balance our budget.

Jennifer

I am only in the beginning stages but, so far, everything in my “plan” to financial stability seems to be going smoothly. I feel more prepared to handle my financial situation.

Deborah

My daughter referred me! This program will help me pay off the debt faster and free up some money to start putting toward my retirement fund.

Leanne

We realized that we had more expenses than income. My counselor helped me prioritize my expenses and informed me of options to handle my debt. She provided suggestions on how to balance our budget.

A partnership focused on:

Managing Debt

Budgeting Assistance

Getting Mortgage Ready

Avoiding Foreclosure or Eviction

Ways we're working together for you

Financial Insights

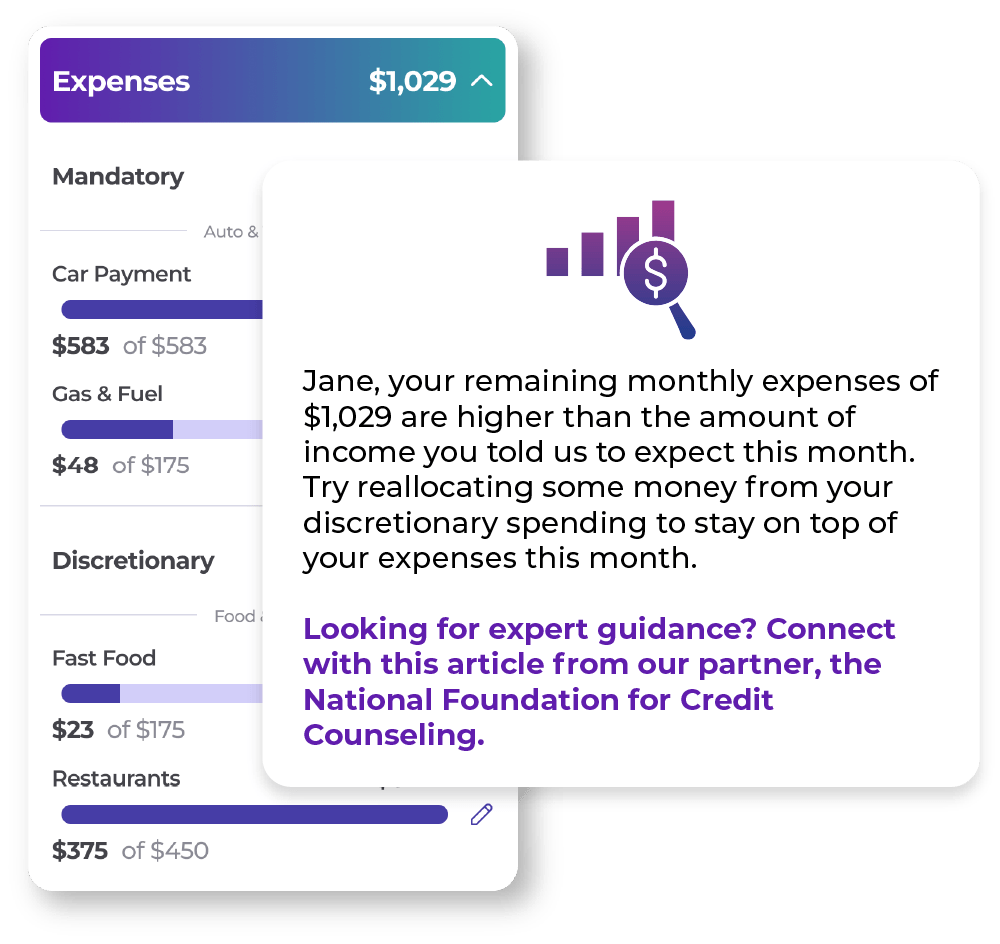

Together, we’re aware of the types of financial challenges you’re most likely to face each month. With Piere’s intelligence, we’re able to analyze your finances and notify you instantly when your debts, income, or spending require attention.

Education & Community

Alongside financial insights, we’ll direct you to free expert tips, community events, how-to videos, and financial education materials that relate to your unique situation.

Access to Help

At any point, you’re encouraged to contact the NFCC directly for a free consultation with a nonprofit, licensed credit counselor. They can help you plan your way out of debt and provide additional resources to help.

Debt is real, and it isn't forever.

While financial situations may differ from person to person, or family to family, debt can feel overwhelming no matter the amount. NFCC-certified Credit Counselors work with consumers to understand their unique financial circumstances, and help create an actionable plan for tackling debt.

Debt doesn't discriminate. The NFCC makes it their mission to help all types of people who want a more secure financial future. You are not alone in your journey—NFCC is here to help pave the way.

Credit Card Debt

Homeowners

Distressed Renters

Students

Self Employed

Military & Veterans

Tips From the Experts:

Why NFCC Does What They Do

Since 1951, the National Foundation for Credit Counseling has provided pathways for millions of people struggling to overcome debt. As a nonprofit organization, the NFCC is dedicated to providing consumers with access to help at low or no cost.

Improving financial health one person at a time.

At its core, the NFCC is an advocate for consumer financial wellbeing. That is why they have built a national network of similarly committed nonprofit Member Agencies. With NFCC-certified Credit Counselors on board, these agencies offer access to financial health for anyone who seeks it.

Providing money management expertise for all.

NFCC believes that diversity and inclusion are critical to the success of its longstanding mission to improve financial well-being for all people. Diversity at all levels of the NFCC informs direction, focus, and success of efforts to reach traditionally under served communities.

Building relationships to benefit consumers.

The NFCC is only as strong as its network of agencies and corporate partners. That is why they continuously work with representatives from large financial institutions to provide financial education and counseling and affordable debt repayment programs.

Don't wait to take the first step toward a brighter future!

The National Foundation for Credit Counseling offers expert guidance, financial education, and personalized plans to help you regain control of your finances. The first step is easy.

Clear benefits.

Beyond its credentials and its decades of service as a nonprofit financial counseling organization, what the NFCC offers is hope. It’s the kind of hope that allows you to envision a bright financial future that is achievable and sustainable.

- Stop collection calls

- Lower interest rates

- One monthly payment

- No hidden fees

- Affordable solutions

- Improved financial health

Johnika Dreher

Your work and business vision have changed the trajectory of my life. You’ve impacted my legacy, how I walk, how I talk, how I live, parent and love. I am different. I am free.

Leanne

We realized that we had more expenses than income. My counselor helped me prioritize my expenses and informed me of options to handle my debt. She provided suggestions on how to balance our budget.

Deborah

My daughter referred me! This program will help me pay off the debt faster and free up some money to start putting toward my retirement fund.

Johnika Dreher

Your work and business vision have changed the trajectory of my life. You’ve impacted my legacy, how I walk, how I talk, how I live, parent and love. I am different. I am free.

Leanne

We realized that we had more expenses than income. My counselor helped me prioritize my expenses and informed me of options to handle my debt. She provided suggestions on how to balance our budget.

Deborah

My daughter referred me! This program will help me pay off the debt faster and free up some money to start putting toward my retirement fund.

You’re one step closer to achieving your financial goals.

NFCC-certified credit counselors are ready to help you with a personalized action plan and resources regardless of your income or financial status. You have choices.