Get expert help with debt relief

Financial freedom begins with our partner, Credit.org. Though our joint efforts, get out of debt, keep or own a home, build credit, and learn how to expertly navigate a lifetime of financial decisions.

Put Credit.org to work if your goal is to:

Got Debt?

Crush Your Debt With a Debt Management Plan

- Pay Off Debt Faster

- One Single Payment

- Goodbye High Interest Rates, Hello Savings

Credit.org’s debt counseling services are designed to empower you on your path to financial success. Call today for your free counseling session and start your personalized Debt Management Plan — because your journey to a debt-free, brighter future starts now!

Build Your Credit

Rebuild Your Credit, Rebuild Your Future

- Get Credit-Building Strategies

- Understand Your Credit Report

- Boost Your Credit Score

Access Credit.org’s expert counselors to navigate credit complexities, boost ratings, manage debt, and make informed financial choices.

Stay In Your Home

Personalized, Expert Guidance

- Pay Off Debt Faster

- One Single Payment

- Goodbye High Interest Rates, Hello Savings

If you are facing home foreclosure or are a renter having trouble making your payments, call us! Our HUD Certified Credit Counselors can help you find resources and program options.

Get Mortgage Ready

Ready To Own?

- Pay Off Debt Faster

- One Single Payment

- Goodbye High Interest Rates, Hello Savings

If you're ready to buy a home, our HUD-certified counselors can guide you through every step of the process, from improving your credit to finding down payment assistance programs. We'll help you create a personalized plan to get mortgage-ready and turn your homeownership dream into reality.

Credit.org is a partner you can trust.

At Credit.org, our mission is clear and powerful: to transform lives by offering expert financial education and coaching that empowers individuals and families to thrive. Through confidential budget counseling and engaging educational programs, we’re committed to guiding you on your path to financial success. Our values fuel everything we do—Integrity to stand by our principles, Quality to uphold the highest standards, Excellence to lead by example, and Compassion to ensure every individual is treated with care and respect, without judgment.

Genevieve R., New York

DMCC really saved me! My counselor helped me set up a budget and was always there for me. My inquiries by phone and email were answered in a timely manner. I highly recommend DMCC!

William, New Jersey

Take Charge America [an FCAA member] literally saved us from extreme debt. From start to finish, everyone that works for this company is helpful, knowledgeable, courteous, friendly and understanding. I was scared putting my finances in their hands, but in four years we paid off over $100,000 in debt – and now we owe no one. I still can’t believe how they have helped change our lives. They are great.

Keith, Oregon

When I first heard about Debt Reduction Services [an FCAA member] on TV, I thought I might give it a try and see if their company really could help me with my credit accounts. It was one of the best decisions I have made in a long time! Thank you so very much!

Genevieve R., New York

DMCC really saved me! My counselor helped me set up a budget and was always there for me. My inquiries by phone and email were answered in a timely manner. I highly recommend DMCC!

William, New Jersey

Take Charge America [an FCAA member] literally saved us from extreme debt. From start to finish, everyone that works for this company is helpful, knowledgeable, courteous, friendly and understanding. I was scared putting my finances in their hands, but in four years we paid off over $100,000 in debt – and now we owe no one. I still can’t believe how they have helped change our lives. They are great.

Keith, Oregon

When I first heard about Debt Reduction Services [an FCAA member] on TV, I thought I might give it a try and see if their company really could help me with my credit accounts. It was one of the best decisions I have made in a long time! Thank you so very much!

Join a HUD-approved homebuyer's class!

Reserve your place in an in-person or virtual government-approved homebuyer classes to become prepared to navigate the home buying process.

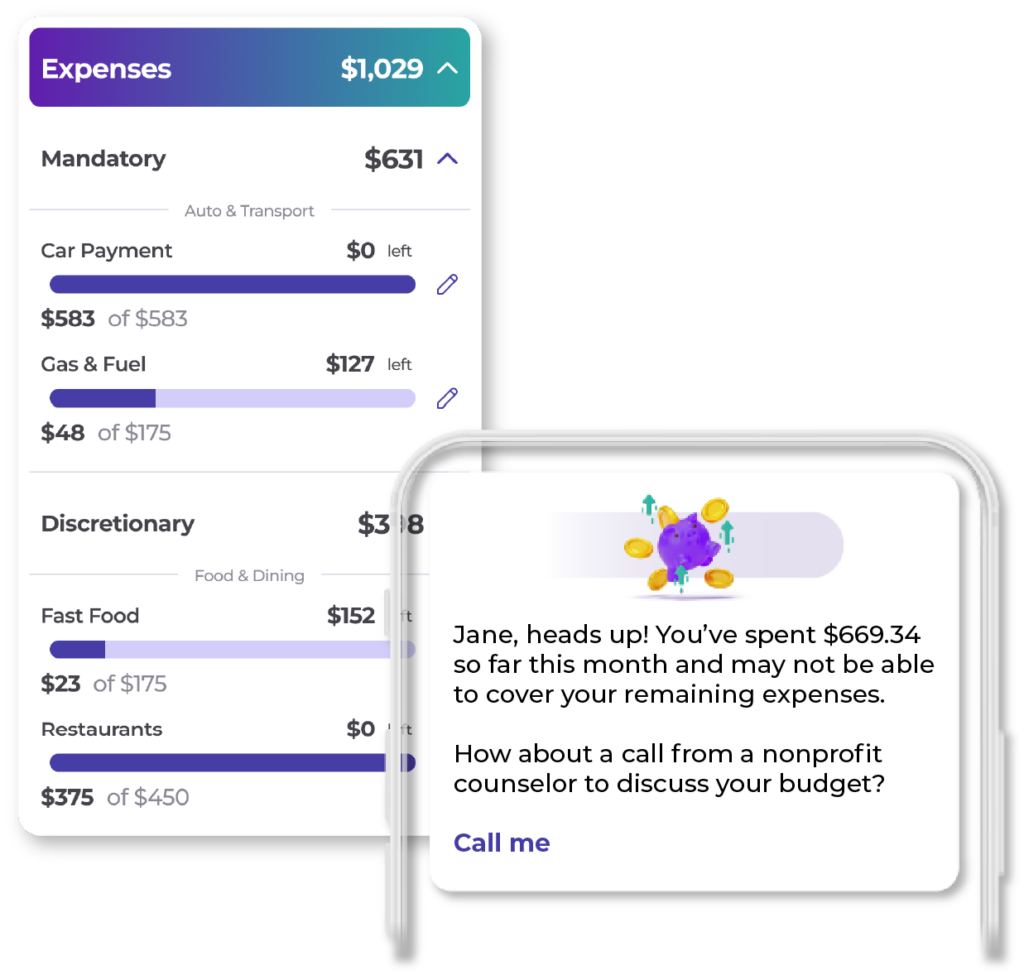

How Piere and FCAA work together

Financial Insights

Together, we’re aware of the types of financial challenges you’re most likely to face each month. With Piere’s intelligence, we’re able to analyze your finances and notify you instantly when your debts, income, or spending require attention.

Education & Community

Alongside financial insights, we’ll direct you to free expert tips, community events, how-to videos, and financial education materials that relate to your unique situation.

Access to Help

At any point, you’re encouraged to contact the FCAA directly for a free consultation with a nonprofit, licensed credit counselor. They can help you plan your way out of debt and provide additional resources to help.

Credit.org recommends these insights:

Courses & Classes

Understand Your Credit Report

Budgeting

Debt Management Program

Courses & Classes

Roadmap to Financial Freedom

Credit Score & Report

Credit Report Review with a Professional

Courses & Classes

Budget 911

Debt Management

What Is a Debt Management Plan & How Can It Help You?

Get financial help and expertise, now.

Complete this brief form and a non-profit counselor will be in touch with you soon for a no-obligation call to discuss your options and answer your questions.

Complete this form to be contacted for FREE by a certified, non-profit counselor to discuss your situation.